Introduction

Financial modeling is how investors predict the future of markets, stocks, or investments using math and computer programs. For small investors—people who invest their own money but don’t have big financial teams—getting accurate models is important but can be difficult because markets are complex.

Quantum computing, a new and powerful type of computing, could change financial modeling in many exciting ways. Even though quantum computers are still developing, their unique abilities might soon help small investors make smarter decisions.

This article explains how quantum computing could impact financial modeling for small investors and why it matters.

What Is Financial Modeling?

Financial modeling uses math and data to estimate how investments might perform. Models can predict stock prices, assess risks, or find the best mix of investments to maximize returns.

Regular computers run these models by analyzing lots of information and running many calculations. However, some financial problems are very complicated and take a long time to solve with today’s computers. This is where quantum computing could help.

What Is Quantum Computing?

Quantum computing uses the principles of quantum physics to process information differently than traditional computers. Instead of bits that are 0 or 1, quantum computers use quantum bits or qubits, which can be both 0 and 1 at the same time.

This allows quantum computers to analyze many possibilities simultaneously, solving certain problems much faster than normal computers.

How Quantum Computing Could Help Financial Modeling

1. Faster and More Accurate Risk Analysis

Risk analysis involves understanding how likely different negative events are, like a stock losing value or an investment failing. Quantum computers can quickly process many possible scenarios and outcomes to give a clearer picture of risk.

For small investors, this means better information on what investments are safe or risky, helping them avoid big losses.

2. Improved Portfolio Optimization

Portfolio optimization is about choosing the right mix of investments to get the best returns while minimizing risk. It’s like trying to find the perfect balance of different stocks, bonds, or assets.

Because there are so many combinations, this problem is very complex. Quantum computers can test many options at once, finding the best portfolio more efficiently than traditional methods.

This could help small investors build smarter portfolios tailored to their goals and budgets.

3. Better Pricing of Complex Financial Products

Some financial products, like options or derivatives, are hard to price accurately because their value depends on many changing factors.

Quantum algorithms can simulate these products more precisely by exploring many possible market conditions at the same time. This means small investors could get more accurate pricing information, helping them make better decisions.

4. Enhanced Fraud Detection and Security

Quantum computing can also improve how financial systems detect fraud or suspicious activity. By analyzing large amounts of data quickly, quantum algorithms could spot unusual patterns that might indicate fraud.

For small investors, this means safer transactions and better protection of their money.

Challenges to Keep in Mind

While quantum computing offers big promise, there are some challenges:

- Technology is still young: Powerful quantum computers are not widely available yet. It may take years before small investors can use them directly.

- Cost and access: Quantum computing services might be expensive at first, limiting access for small investors.

- Learning curve: Understanding and trusting quantum-powered financial models will take time and education.

However, as the technology matures, many financial companies are likely to offer quantum-enhanced tools for all investors.

Real-World Examples and Progress

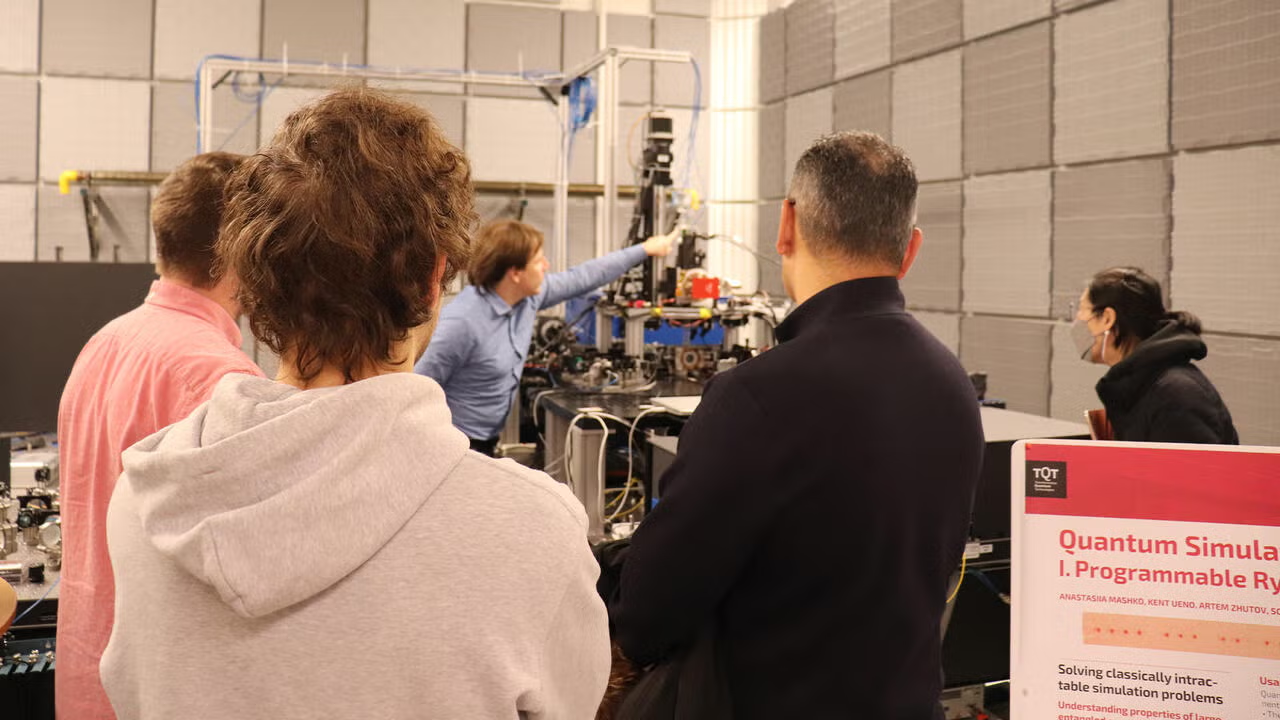

Some big banks and financial firms are already experimenting with quantum computing to improve their models. For example, they use quantum algorithms to optimize portfolios or simulate market scenarios faster.

As these companies develop tools, small investors may soon access quantum-powered apps or platforms that simplify complex financial analysis.

What Small Investors Can Do Now

Even if quantum computing isn’t widely available yet, small investors can:

- Stay informed about quantum developments and how they might affect investing

- Learn the basics of financial modeling and risk management

- Use current technology tools that incorporate advanced algorithms and AI, which can be stepping stones toward quantum computing

Being ready to adopt new tools early can give small investors an edge in the future.

Conclusion

Quantum computing has the potential to transform financial modeling by making risk analysis faster, portfolio optimization smarter, and complex pricing more accurate. While still developing, this technology could help small investors make better decisions and compete with larger players.

Understanding how quantum computing might impact finance today prepares small investors for a future where advanced technology plays a key role in managing money. The future of investing looks exciting — and quantum computing could be a big part of it.

Leave a Reply