Introduction

Small local businesses often face challenges when it comes to accepting payments. They want to make sure transactions are fast, safe, and cost-effective. Blockchain technology offers a new way to handle payments that can help businesses protect their money and customers.

Even though blockchain sounds complicated, it’s easier to understand than you might think. This article explains how small local businesses can use blockchain for secure payments and why it might be a smart choice.

What Is Blockchain?

Blockchain is a special kind of digital ledger—a way to record transactions. Imagine a notebook that everyone can see but no one can erase or change. Every time someone makes a payment, it gets written into this notebook and shared with many computers around the world.

Because many copies of the notebook exist, it’s almost impossible to cheat or hack. This makes blockchain very secure and trustworthy.

Benefits of Blockchain for Small Businesses

Using blockchain for payments offers several advantages:

- Security: Transactions are encrypted and verified by many computers, making fraud and hacking very difficult.

- Transparency: Both buyers and sellers can see the transaction details, increasing trust.

- Lower Fees: Blockchain payments can reduce fees charged by banks or credit card companies.

- Speed: Payments can be processed quickly, even across countries, without waiting days for bank clearance.

- No Need for Middlemen: Blockchain allows direct transfers between businesses and customers without extra parties.

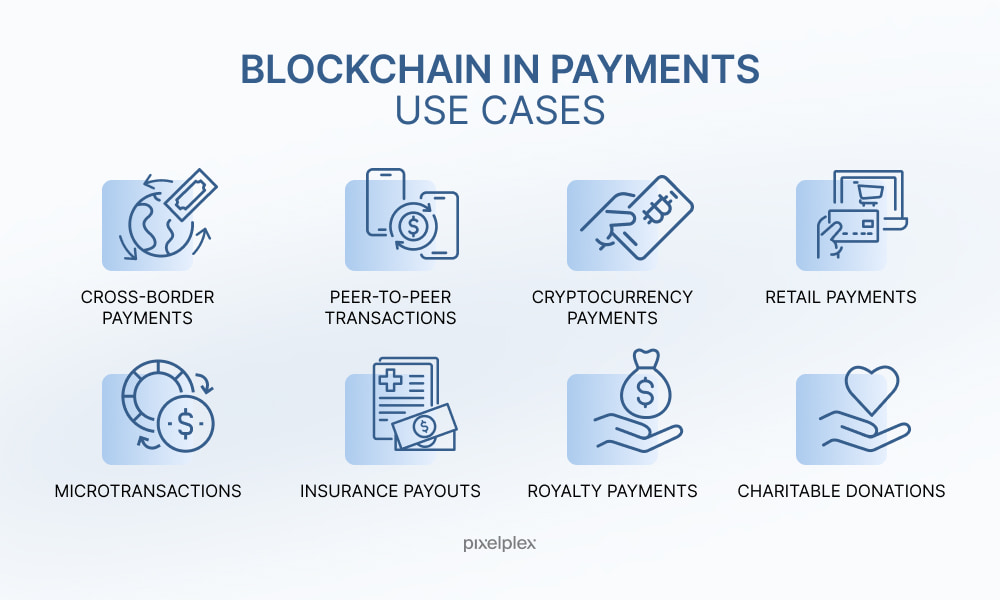

How Small Businesses Can Use Blockchain for Payments

Here are some ways small local businesses can start using blockchain payments:

1. Accepting Cryptocurrency Payments

Many blockchains support cryptocurrencies like Bitcoin or Ethereum. Small businesses can accept these as payment using a digital wallet and a payment app.

- Digital Wallet: A software app that stores cryptocurrency securely.

- Payment Processors: Services like BitPay or Coinbase Commerce help convert crypto payments into regular money, making it easy for business owners.

Accepting cryptocurrency can attract tech-savvy customers and open new payment options.

2. Using Stablecoins for Price Stability

Cryptocurrencies can be volatile, meaning their value changes quickly. Stablecoins are a type of cryptocurrency designed to keep their value stable by being backed by real money or assets.

Using stablecoins lets businesses enjoy the benefits of blockchain payments without worrying about sudden price swings.

3. Integrating Blockchain with Point-of-Sale Systems

Some modern payment terminals now support blockchain payments. Small businesses can work with payment providers that allow customers to pay with crypto directly at checkout.

This integration makes it simple for customers and staff to use blockchain payments without changing how they run the store.

4. Implementing Smart Contracts for Payments

Smart contracts are computer programs that automatically execute agreements when certain conditions are met. For example, a smart contract can release payment only after a customer confirms delivery.

Small businesses can use smart contracts to:

- Automate payments for services

- Reduce disputes by having clear, automatic terms

- Improve trust in transactions

Things to Consider Before Using Blockchain Payments

While blockchain has many benefits, small businesses should keep a few things in mind:

- Regulations: Cryptocurrency laws vary by country. It’s important to check local rules before accepting crypto payments.

- Volatility: If not using stablecoins, the value of cryptocurrencies can change quickly, affecting profits.

- Technical Knowledge: Some setup and understanding of wallets and blockchain basics are needed.

- Customer Base: Not all customers use or want to pay with cryptocurrency, so it may suit certain businesses better than others.

Real-World Examples of Small Businesses Using Blockchain

- A local coffee shop accepts Bitcoin and Ethereum through a simple payment app, attracting new customers interested in crypto.

- An artisan sells handmade goods online and uses smart contracts to automate payment once customers receive their orders.

- A small grocery store uses stablecoins to send and receive payments from suppliers internationally without high bank fees.

Conclusion

Blockchain technology offers small local businesses a secure, transparent, and efficient way to accept payments. By understanding the basics and choosing the right tools, business owners can tap into new opportunities and protect their transactions from fraud.

While it might not replace traditional payments overnight, blockchain payments are becoming easier to use and more popular. For small businesses ready to innovate, blockchain can be a smart step forward in making payments safer and simpler.

Leave a Reply